The crypto market showed resilience today, March 14, 2025.

Most of the top digital assets recorded slight gains amidst a backdrop of macroeconomic shifts and regulatory developments.

It includes resilient performances by Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Hyperliquid (HYPE).

Also notable are slight declines for Pi (PI) and Mantra (OM), which pared gains after a significant surge earlier in the week.

Here’s the price updates for some of the coins over the past 24 hours.

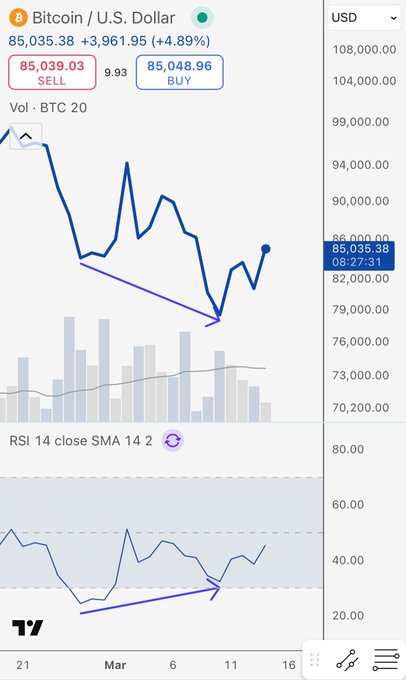

Bitcoin (BTC) breaks $84,000

Bitcoin continued its upward trajectory, climbing 5% in the last 24 hours to trade at approximately $84,400.

The surge comes on the heels of President Trump’s recent executive order on March 7, which directed the use of seized BTC to bolster the US national reserve.

Amid the pro-crypto stance, optimism has held high. However, some analysts caution that broader economic concerns—like potential tariff wars—could temper gains.

BTC’s market dominance remains strong, with trading volume spiking as institutional interest persists.

Scott Melker, aka The Wolf of All Streets, says Bitcoin is showing bullish divergence signs.

$BTC Daily No signal is perfect, but bullish divergence with oversold RSI is about as close as you get. In all my years of trading and using different strategies, this is the only one I truly watch at this point. Been harping on this for years.

Ethereum price- bulls eye key level

Ethereum saw a modest increase of 4.3%, and hovered near $1,930.

The second-largest cryptocurrency by market cap has been buoyed by ongoing developments in decentralized finance (DeFi) and anticipation around staking options for ETH exchange-traded funds.

However, ETH’s price action has been less volatile and bulls continue to struggle below the psychological $2,000 level.

While the market is cautious, a flip in sentiment among traders could help buyers reclaim the key level. Pain would mean a retest of support levels.

Analyst CryptoELITES suggests a reversal is likely.

Chainlink (LINK) shows bullish signs

Chainlink posted a notable 12% aurge on Mar. 14, trading at $14.45 at the time of writing.

The oracle network’s growth is tied to its expanding role in smart contract ecosystems.

One positive drive in recent weeks has been speculation around Chainlink’s trajectory amid US support for innovation.

While no major catalyst has emerged, interest in LINK’s price is buzzing holders.

Read more here: Whales cash in as Chainlink crypto price readies for a falling wedge breakout

Hyperliquid (HYPE) surges

Hyperliquid emerged as a standout performer, jumping 16% in 24 hours to hit $14.41

Decentralized perpetual futures growth drives this move as is the latest developments around it.

HYPE’s climb reflects a broader trend of altcoins gaining traction as investors diversify beyond BTC and ETH, though its volatility remains a point of discussion.

However, the altcoin is down 26% in the past two weeks and has shed more than 58% of its value since peaking at $35 in December 2024.

Why did the HYPE price soar today? Read more here.

Top losers today

Pi (PI) leads the list of top coins to hit sell-off pressure in the past 24 hours.

The PI token, among those to explode recently, was down 5.6% as buyers struggled near $1.55.

Mantro (OM), down 2% and Tron (TRX) down 1%, are the top losers among the 100 largest coins by market cap. Other coins to pare gains include aelf (ELF) and Solv Protocol (SOLV).

Overall market update

There’s upward movement for several of the top coins, with this coming after a downturn earlier in the day.

Per CoinMarketCap, the crypto market’s total capitalization edged up by 3.83% to $2.75 trillion as of 1.20 pm ET.

The market is looking to shrug off earlier fears of a US stock sell-off. Some analysts noted the pain could persist amid tariffs concerns.

However, despite the trade war, Trump’s pro-crypto policies, including the strategic Bitcoin reserve, have injected confidence.

Chainlink and Hyperliquid have also benefited from positive sentiment, the latter after notable chatter on social media over a recent massive liquidation event.

As of writing, the total open interest stood at over $93 billion, 5.9% up.

Meanwhile, the total crypto liquidation per Coinglass was just over $200 million and global daily volume stood at $83 billion, down about 6% in the past 24 hours.

Source : https://invezz.com/news/2025/03/14/crypto-price-update-march-14-btc-eth-link-hype-and-pi/